TRUSTED BY FORWARD-THINKING LENDERS

Leading mortgage lenders and banks are already using Ai in their mortgage lending process.

Top mortgage lenders and banks are already equiping their loan officers with modern AI technology to close mortgage loans faster. Will you join them or be left behind?

Start Closing More Loans TodayIt's at least 10 times faster. It really enhances what an LO can do... turning your originators into superheroes.

Some of our happy customers

SAVES TIME

Why Choose AI Mortgage Lending?

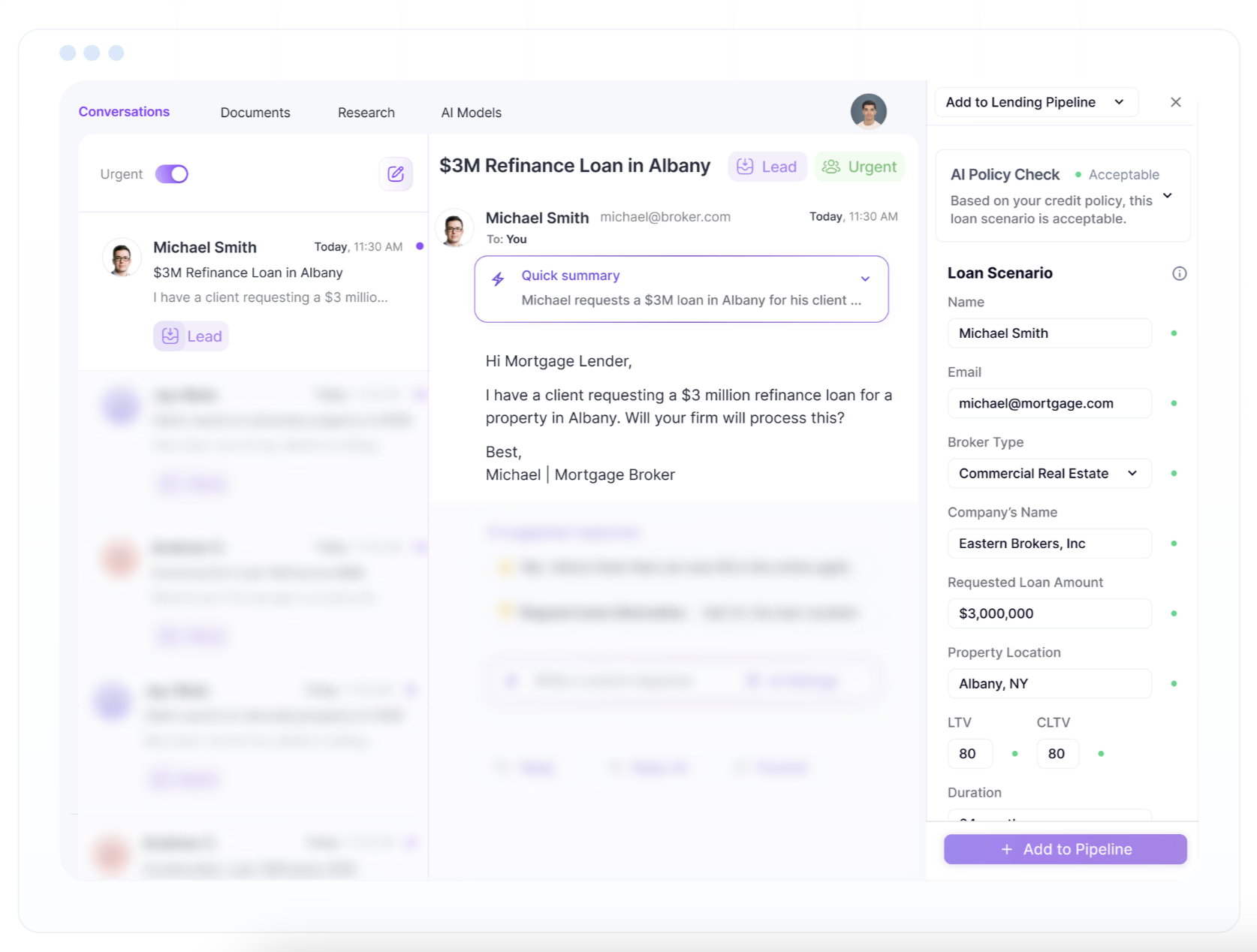

AI Mortgage Lending is reshaping the mortgage industry by automating processes, enhancing decision-making, and delivering personalized experiences. Our Generative AI solution integrates seamlessly with your existing systems and loan origination software, offering unparalleled efficiency and accuracy in every step of the mortgage process.

In today’s competitive mortgage market, adopting AI-driven solutions is essential for lenders to thrive and deliver exceptional service. With a custom large language model tailored for the mortgage industry, lenders can ensure privacy and security while staying up-to-date with real-time regulatory changes. By integrating with existing systems, AI streamlines lending workflows, reduces risks, and enhances efficiency, delivering a faster, more compliant mortgage experience.

Automate manual mortgage lending tasks to achieve 90% faster loan close times

Speed up loan origination, underwriting, and servicing with AI. Leverage generative AI to automate underwriting and document review processes for faster decision-making. Artificial intelligence has become the cornerstone of innovation in the mortgage industry. Our system uses machine learning algorithms to analyze data beyond traditional credit scores, offering a more comprehensive view of borrower risk. This automation not only reduces the time and effort required to process loans but also significantly increases efficiency.

Process Bank Statements, 1099s, tax forms and other documents in seconds

Automate data capture to speed up the mortgage lending process from weeks to days. Extract borrower information from complex documents that contain text, images, tables, and other data formats instantly. Using AI, lenders can use natural language to find the information needed for decision-making in seconds. Data can be synced with CRM or other loan origination system for a more unified workflow. Generative AI enhances data extraction accuracy, ensuring that even unstructured formats are processed seamlessly.

Check borrower eligibility in seconds and offer personalized mortgage suggestions

Automatically check loan scenarios to ensure borrower eligibliity. If the borrower is ineligible, the system can provide personalized recommendations to help them qualify for a loan. This increases the number of originations, improves the quality of borrowers by minimizing risk, and leads to a better experience for mortgage lenders and borrowers alike. Our AI agents can cross-reference data with Fannie Mae requirements, reducing risks and ensuring adherence to industry standards.

Automate follow up with mortgage brokers and borrowers

Most loan officers spend a lot of time following up with leads (brokers and borrowers). Such as asking leads to upload missing documents. This can sometimes take up to 80% of their time. AI can create personalized follow-up messages and send them automatically. This can save a lot of time and increase lead conversion rate by over 70% and increase customer satisfaction. With Generative AI, these messages can be tailored to reflect the borrower's unique circumstances, improving engagement. Ultimately, this automation fosters better customer experiences by ensuring timely communication and a smoother process for all parties involved.

Get Instant Answers to Mortgage Lending Guidelines and Regulations

The mortgage industry’s guidelines and regulations are constantly evolving, making compliance a challenge. AI-powered large language models (LLMs) simplify this by ingesting hundreds of thousands of rules and offering instant, accurate answers through natural language processing (NLP). Loan officers can use everyday language to search for underwriting systems criteria or verify eligibility during the application process, saving time and improving regulatory compliance.

AI Powered Background search for mortgage lending

Imagine having an army of AI agents that do background check on borrowers, properties, and other factors that affect the loan approval process. This can save a lot of time and reduce the risk of bad mortgage loans. Lenders can automatically get a borrowers profile, employment history, and other important information and news about them in seconds. This provides a clear picture of the applicant. Our AI agents for mortgage lending pull data from various sources public records, and social media, to identify potential risks and opportunities. Generative AI synthesizes this data into comprehensive borrower profiles, aiding in better decision-making.

INCREASE REVENUE FOR MORTGAGE LENDERS

Leveraging AI for faster loan origination and increasing revenue

AI is revolutionizing the mortgage lending industry, bringing a new level of efficiency and accuracy to loan origination, processing, and servicing. By integrating AI with existing loan origination software (LOS), lenders can automate critical tasks, such as data capture, document verification, and eligibility checks, resulting in faster loan approvals. AI-driven solutions streamline the loan application process by enabling mortgage brokers to quickly access and analyze borrower data, improving decision-making and customer service. This enables lenders to process much more loan applications than previously possible and increase bottom-line revenue. Through advanced data analysis and predictive analysis, AI goes beyond traditional credit scoring methods, using machine learning algorithms to evaluate a broader range of financial behaviors, such as payment history, debt-to-income ratios, and data hidden deep inside loan applications.

AI Mortgage Technology is here, don't be left behind

AI is already transforming loan processing for top mortgage lenders, but here's the key part: You don't need a top mortgage lender to implement AI. By integrating a system like ours into your loan origination software, you can immediately start leveraging the benefits of AI. We're at the dawn of a new digital transformation era in the mortgage industry. With AI-powered tools, going beyond simple credit scoring checkers, mortgage loan officers can deliver better customer experiences by offering more personalized loan recommendations and faster processing times. Mortgage brokers benefit from real-time insights and smarter tools that improve efficiency and reduce manual work, allowing them to focus on growing their business and building client relationships. The result is a more responsive, transparent, and customer-centric mortgage process that is poised for continued success in the future.

RESULTS OF USING AI MORTGAGE LENDING

What early adopters of AI Mortgage Lending are saying

Early adopters of using Ai in the mortgage lending process are experiencing tremendous benefits. like automated document review and verification processes, enhanced decision-making, and are delivering better experiences to their borrowers. This transformation has set a new benchmark for efficiency and transparency in the mortgage market, benefiting both lenders and borrowers. By integrating Generative AI, lenders can provide even more customized solutions, meeting evolving borrower expectations.

Mortgage loans can now be closed in days instead of weeks, and the entire process is more transparent and efficient. Borrowers are happier, and lenders are saving time and money. It's a win-win for everyone involved.

A Mortgage Loan officer no longer has to spend hours reviewing documents, verifying information, and manually processing applications. Instead, they can focus on building relationships with borrowers and growing their business.

Start Closing More Loans TodayIt's at least 10 times faster. It really enhances what an LO can do... turning your originators into superheroes.

Using AI in our mortgage lending process has completely transformed our operations. We've seen faster approvals, reduced costs, and a better overall borrower experience. It's a game-changer for our lending process.